“Bull markets are born of pessimism, grow on skepticism, mature on optimism, and die on euphoria.”

The current US business cycle is closing in on nine years, which makes it the second-longest bull run of the post-WW II era. Even the most bullish and optimistic investors have been surprised by the strength and resiliency of today’s market.

The impact of the recent tax cut and decreased government regulation on businesses has been welcomed by markets, and soaring business optimism is already translating into nice gains for the market again in 2018. As of January 25, 24% of the companies in the S&P 500 have reported actual earnings and sales numbers for the fourth quarter. Of these companies, 81% have reported sales above estimates and 19% have reported sales below estimates,” according to John Butters of Fact Set.

In Brief:

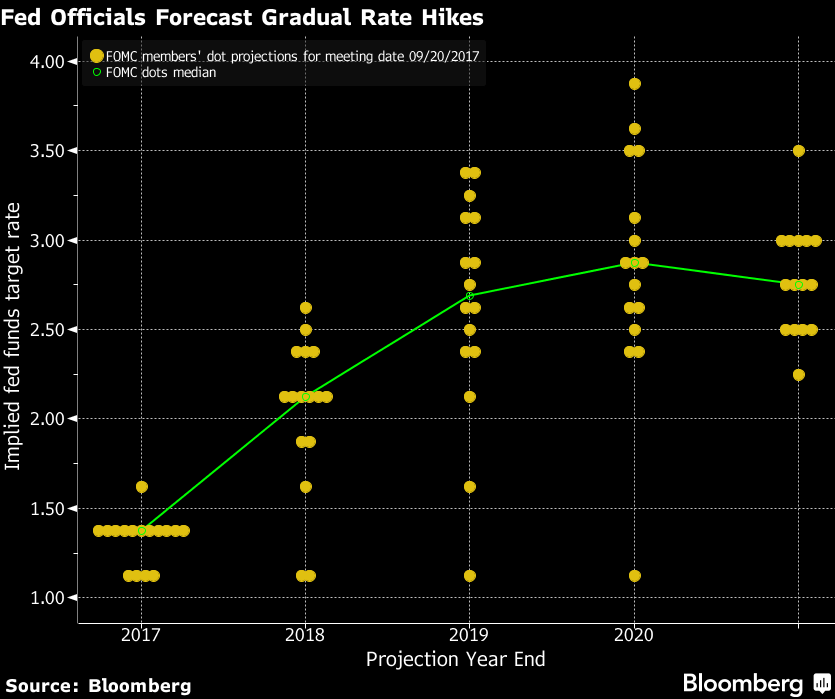

Much of the Fed's policy this year will be influenced by what other central banks decide. Given that both the European Central Bank and the Bank of Japan continue to be plagued by low inflation, the consensus view is the Fed will likely tighten three times in 2018 with a median estimate for federal funds rate at 2.1%. The pace of “quantitative tightening” and the market's reaction will be an important factor not only for credit markets but also for equity markets in 2018. See chart at: St. Louis Fed.org.

Excessively easy Central Bank monetary policies have led to a world awash in liquidity, leading to overvalued equities. Has peak liquidity met peak positioning in stocks? The price/earnings ratio for the S&P 500 is now 26.8, higher than at any time in the 100 years before 1998 and 70% above its historical average. According to Liz Ann Sonders, Chief Investment Strategist at Charles Schwab, "the danger is that the bar set for investors in 2018 is too high."

Markets lead the economy and according to earnings data tracked by Fact Set since 2008, a record number of S& P Companies are beating earnings in Q4 2017. I expect positive returns from U.S. and international markets, with no recession in the foreseeable future. S&P profits should expand by 10% in 2018, having grown 11% in 2017.

U. S. Equity Markets:

As the adage says, money goes to where it’s treated best. The tax bill that was passed is already leading to investments in the U.S. by corporations. One needs to look no further than the recent Apple news — the vast majority of the $252 billion of its cash that's held abroad is being brought back to the U.S. According to their press release on Apple.com: “Apple, already the largest U.S taxpayer, anticipates repatriation tax payments of approximately $38 billion as required by recent changes to the tax law. A payment of that size would likely be the largest of its kind ever made. Apple expects to invest over $30 billion in capital expenditures in the U.S. over the next five years and create over 20,000 new jobs through hiring at existing campuses and opening a new one. Apple already employs 84,000 people in all 50 states.”

FAAN(M)G Stocks’ focus remains a worry for me in 2018. The advance in the market in 2017 was largely fueled by a handful of glamorous mega-caps. In fact, a recent analysis shows that nearly 40% of last year’s gain in the S&P 500 can be linked to just four stocks. Historically, narrow advances have tended to be a warning sign: Remember the Four Horsemen of the internet in 2000 - Sun Microsystems, Cisco, EMC, and Oracle? Today, we have the FAANG Stocks. This select group of stocks is made up of Facebook, Amazon, Apple, Netflix, and Google/Alphabet. One could also substitute an old favorite, Microsoft, for Netflix to yield FAAMGs. Note: It took Microsoft over 15 years to reach its old high of $53 set in March 2000 .

Investors have piled into this select group of stocks with strong earnings growth prospects. Earnings disappointments by members of the FAAMGs/FAANGs could lead to a disproportionate impact on index returns in 2018.

On the bright side of things, small-caps and mid-caps broke out of their multi-year malaise's in late September 2017 and are now helping lead the market higher. As Treasury Secretary, Steve Mnuchin reiterated this past week at Davos, “America is open for business!”

For 2018, we continue to overweight select U.S. mega caps, small- and mid-cap value, materials, and commodities.

Note: Market-weighted benchmarks are riskier than they appear and shifts could happen quickly given the prominent role of ETFs in investors’ portfolios today leading to increased market volatility in 2018. Many investors fail to appreciate that indexing to market-weighted benchmarks such as the S&P 500 has created a buy-at-any-price form of momentum investing.

International Markets:

According to the International Monetary Fund (IMF), the Fed’s balance sheet reduction could cause investors to re-balance their portfolios globally and cut flows to emerging economies by as much as $55 billion over the next few years. The resulting outflow will lead to an uptick in emerging market bond yields and could cause concerns about default in countries like China. Therefore, one cannot rule out a period of “risk-off” in global markets in the near-future, and this would boost our dollar and market volatility.

The decline in our dollar helped foreign stocks outperform the S&P 500 in 2018. Continued dollar weakness and the synchronized global recovery continues to favor international and emerging market investments. From a valuation perspective, international markets also look compelling.

Commodities:

The dollar should continue to remain weak in 2018 and provide a tailwind for an increase in commodity prices and the earnings of U. S. multinationals. The basic story for commodities in 2018 is that as the synchronized global recovery gains momentum, it should lead to increased demand and concomitant higher prices for basic materials.

Against the backdrop of a weakening dollar and a synchronized global economic recovery, oil helped lead the market recovery post-election after being pounded in 2016 by the Saudi’s effort to drive U.S. producers out of business. Tactically speaking, commodities generally outperform during the latter stages of a market cycle and this time is no different. I initiated exposure to commodities in December 2017 based on my outlook on continued dollar weakness in 2018 and the current market cycle. For now, the dollar could decline further against the Yen and Euro, especially if the Trump administration ignites a trade war as it pursues its fair trade, "America first" agenda. (see dollar index chart above).

Note: The new tax holiday given to U.S. corporations repatriating foreign profits could increase the demand for our dollar and lift the price of it later this year. Also, should the Fed raise rates more aggressively than expected, the greenback’s fortune could reverse, putting pressure on commodity, emerging, and international investments.

Fixed Income:

After declining for three decades, long-term interest rates have stopped trending lower. Valuations of corporate bonds, in particular, appear stretched, while quality has fallen and risks have risen. Investors are not usually rewarded when they dip down to the lower-quality segments of the high-yield and corporate bond market in the late stages of a bull market. The fact is the Fed should have started raising the fed-funds rate several years ago. Now the Fed faces the tough challenge of trying to contain inflation and reduce elevated asset prices—without pushing the economy into a recession.

Given that both the European Central Bank and the Bank of Japan continue to be plagued by low inflation, the consensus view is the Fed will likely tighten three times in 2018 with a median estimate for federal funds rate at 2.1% (see Fed dot plot above).

Fixed income still plays a pivotal role as a stabilizing influence in a diversified portfolio, especially for retirees and pre-retirees. This function is crucial in today's environment, where central banks are retreating from providing quantitative easing and debt levels are elevated. Fixed income investments should be focused on prudent capital preservation at this late stage in the market cycle. Thus, we are keeping our bond allocation defensive and favor a laddered portfolio of high-quality investment grade corporates and municipals. I stated in a February 2016 research piece that, historically, the sweet spot in the yield curve during a rising rate environment has been the five-to-seven-year maturity range. For a closer look at the Cambridge bond strategy, check out our post: Ready your bond portfolio for reflation.

Municipal bond yields should gradually improve -- the backdrop of lower issuance in early 2018 should support muni bond prices in the near-term. The new $10,000 limits for deducting state tax against one’s Federal tax makes municipal bonds even more attractive to wealthy individuals living in high-tax states like California, Connecticut, New York, New Jersey, and Maryland. The two categories that look are appealing within the muni space are the top ten U.S. ports and airports.

Note: On Event Risk. As President Donald Trump faces the Mueller team interview, we cannot rule out the possibility of a constitutional crisis in 2018, which could impact markets. In fact, uncertainties related to current investigations by the Special Counsel may turn out to be a more significant market risk in 2018 than extended valuations, Fed hikes, trade wars, Iran, or North Korea.

The Bottom Line:

The recent corporate tax cut and elimination of over 800 government regulations should help S&P profits expand by 10% in the year ahead and GDP growth could approach 3% in 2018 for the first time in nearly a decade. From a technical standpoint, the U.S. market is showing signs of healthy sector rotation, which is the lifeblood of a bull market. The "break-out" performance turned in by small-caps in Q4 2017 is also a positive sign for investors. However, with the price/earnings ratio for the S&P 500 around 26x, the market is pricey, and investors may want to be cautious in putting new money to work in equities.

Lastly, the elephant in the living room for me remains the actions of Central Banks in 2018. Will our new Fed Chairman, Jerome Powell, prove to be a dove and gently raise interest rates?

After the stellar performance turned in by global markets in 2017, it’s particularly important to revisit your investment portfolio allocation and make sure it’s properly aligned with your risk profile and financial goals. Meeting your goals and return targets without exposure to excessive risk takes thoughtful planning and a disciplined investment strategy.

In our model portfolios, I continue to seek opportunities to make strategic allocation shifts and tactical investments to enhance returns. I will be vigilant in looking for a peak in earnings growth in 2018. Should you have any questions or concerns, please feel free to contact Cambridge Wealth Management.

Sources: Wall Street Journal Online; Bloomberg News; Investor’s Business Daily; Forbes.com; CNBC News; Reuters News; Federal Reserve Bank of St. Louis.

The information contained in this piece is intended for information only and should not be considered investment or tax advice. Please contact your financial adviser with questions about your specific needs and circumstances.Nothing contained herein shall constitute a solicitation, recommendation or endorsement to buy or sell any security. The information and opinions expressed herein are obtained from sources believed to be reliable, however their accuracy and completeness cannot be guaranteed. All data are driven from publicly available information and has not been independently verified by Cambridge Wealth Management, LLC. Opinions expressed are current as of the date of this publication and are subject to change. Certain statements contained within are forward-looking statements including, but not limited to, predictions or indications of future events, trends, plans or objectives. Undue reliance should not be placed on such statements because, by their nature, they are subject to known and unknown risks and uncertainties.

INDEX DESCRIPTIONS:

The past performance of an index is not a guarantee of future results.

The following descriptions, while believed to be accurate, are in some cases abbreviated versions of more detailed or comprehensive definitions available from the sponsors or originators of the respective indices. Anyone interested in such further details is free to consult each such sponsor’s or originator’s website.

Each index reflects an unmanaged universe of securities without any deduction for advisory fees or other expenses that would reduce actual returns, as well as the reinvestment of all income and dividends. An actual investment in the securities included in the index could require an investor to incur transaction costs, which would lower the performance results. Indices are not actively managed and investors cannot invest directly in the indices.

S&P 500®: Standard & Poor’s (S&P) 500® Index. The S&P 500® Index is an unmanaged, capitalization-weighted index designed to measure the performance of the broad US economy through changes in the aggregate market value of 500 stocks representing all major industries.

iShares MSCI Emerging Markets ETF (EEM) seeks to track the investment results of an index composed of large- and mid-capitalization emerging market equities.

Vanguard FTSE Emerging Markets ETF (VWO) invests in stocks of companies located in emerging markets around the world, such as China, Brazil, Taiwan, and South Africa. Goal is to closely track the return of the FTSE Emerging Markets All Cap China A Inclusion Index.